Since 1960, China’s diamond tool industry has experienced rapid development, driven by the high demand for diamond tools in various application industries, forming multiple complete industrial chains. According to the analysis of Diawe Tools, these industries mainly include the stone, ceramics, geological mineral mining, construction engineering, and semiconductor industries.

Here, let’s learn about the development background of these industries in China and their association with diamond tools.

Stone Industry

Rich Stone Reserves

China has abundant natural stone resources and a wide variety, distributed in various provinces.

The total reserves of marble are over 50 billion cubic meters, and the estimated granite reserves are 24 billion cubic meters. As of the end of 2006, China had discovered and utilized 1492 types of stone, including 829 types of granite and 663 types of marble.

The provinces with the most varieties are Fujian, Guangdong, and Shandong, followed by Heilongjiang, Liaoning, Zhejiang, Jilin, and other provinces. The granite reserves in these seven provinces account for more than half of the total predicted reserves of China. Except for Shanghai City and Hainan Province, marble is distributed in every province of China.

China also has abundant reserves of slate, mainly distributed in provinces such as Hebei, Jiangxi, Shaanxi, and Shanxi.

Sandstone is mainly distributed in Sichuan, Yunnan, and Shanxi, with the highest reserves in Yunnan and Sichuan.

The abundant stone resources have laid a solid foundation for the development of China’s stone industry, further affecting the development of the diamond tool industry.

Improvement of Stone Production Technology

Since the 1980s, China has imported over 400 sets of stone processing production lines from developed countries such as Italy and Japan, spending over 300 million dollars. The import of technologies and types of equipment has significantly improved China’s stone production capacity and product quality.

Based on this, digestion, absorption, and innovation have achieved localization, enabling the Chinese stone industry to achieve mechanization in the entire process of sawing, polishing & grinding, and cutting in processing and production lines, and the degree of automation has also been continuously improved.

A Large Number of Stone Enterprises

The abundant natural stone resources, import of production technology, and independent innovation have led to the vigorous development of China’s stone industry. Currently, there are 30000 stone production enterprises in China, laying the foundation for China’s position as a major producer, consumer, and trading country in stone production, also promoting the development and improvement of diamond tools.

Ceramic Industry

China is a major producer and consumer of ceramics, leading other countries since 2000. By 2021, the total production of ceramic tiles in China has reached 8.17 billion square meters per year, accounting for 44.55% of the world’s total production. The consumption of ceramic tiles has reached 8.268 billion square meters, accounting for 45.41% of the world’s total consumption.

On the basis of traditional ceramic production technology, Chinese ceramic factories have also upgraded their ceramic production technology and improved the production efficiency and quality of ceramics by importing a large number of Italian ceramic production equipment. Gradually, they have formed ceramic production bases in Foshan, Guangdong, Zibo, Shandong, and Gao’an, Jiangxi.

China’s ceramic processing diamond tools, such as diamond calibrating rollers, squaring & chamfering wheels, grinding wheels, diamond saw blades, and diamond abrasives, have occupied the domestic market with good cost-effectiveness. While replacing imported diamond tools, China’s diamond are now exported in large quantities to the international market.

Geological and Mining Industry

China is rich in geological, mineral and hydraulic resources. Oil is widely distributed in Daqing, Liaohe, Shengli, Zhongyuan, Changqing, Sichuan, and Karamay, Xinjiang. Coal accounts for 64% of China’s basic energy consumption. Therefore, the mining of minerals provides a huge market for diamond tools.

In recent years, the demand and application of coal field geological drill bits, metal mine geological drill bits, hydropower engineering drill bits, petroleum composite drill bits, and coal field uranium rod composite drill bits have continued to expand, effectively promoting the production, development, and export of diamond tools for geological exploration in China.

Construction Industry

With the active promotion and expansion of domestic demand by the Chinese government and the strategic decision to develop the northwest region, the “five vertical and seven horizontal” highway construction, the “eight vertical and eight horizontal” railway network framework, the rapid construction of various types of office buildings, office buildings, and residential housing nationwide, the construction of high-speed railways, the construction of urban subways and light rails, and the expansion and maintenance of airports have provided a huge market for diamond construction tools.

Laser-welded diamond saw blades and core drill bits have achieved rapid development and become the major exporting products of China.

Semiconductor Industry

The electronic semiconductor industry has developed into the largest pillar industry of China’s national economy and social development. Currently, over 95% of semiconductor devices and over 99% of integrated circuits (ICs) are made of silicon materials.

At the end of the 20th century, there were a total of 949 chip production lines in the world, with only 25 in China, accounting for 2.6% of the world. After years of development, China’s total silicon production capacity in 2018 was 310 million square inches. It is expected to reach 631 million square inches by 2024 and 875 million square inches by 2029. By 2023, the share of semiconductor production capacity of the China Mainland accounts for 19.1% of the world, and China Taiwan account for 22.0%. It is expected that the share of semiconductor production capacity of the China Mainland will continue to increase gradually, and will become the first in the world by 2026.

The rapid development of China’s semiconductor industry has brought high demand for silicon material processing, and diamond tools, especially high-end diamond tools, as an essential tool for silicon material processing, have a great market and prospect.

Technological Development of Diamond Tools

The diamond tool industry chain includes upstream diamond manufacturing, various binders, metal powders, metal blanks, etc., midstream diamond tool manufacturing enterprises, and downstream industries such as stone, ceramic tiles, and construction etc. The technological development of upstream industries has brought huge innovation to diamond tools.

In the manufacturing of artificial diamonds, the continuous improvement and development of large tonnage and large-diameter hexagonal top pressing equipment, the application of powder catalyst synthesis blocks, the continuous improvement of large cavity synthesis processes, and the large-scale intensive production of diamonds have led to China’s diamond single crystal production exceeding 20 billion carats (1 carat=200mg), accounting for more than 80% of the world’s production capacity (according to 2020 statistical data), and becoming the country with the largest diamond production. The huge production capacity provides high-quality and inexpensive diamonds for midstream diamond tool enterprises.

The diamond composite sheets produced in China meet the demand for drilling in domestic oil fields and coalfields, and are exported overseas.

To meet the demand for high-quality powders for diamond tools, Chinese companies have launched many types of metal pre-alloy powders that are suitable for various purposes.

The metal blank body produced by metal manufacturers can fully meet the requirements of domestic diamond tool manufacturers for different specifications, purposes, and production processes, and is exported to foreign countries.

Conclusion

On the basis of the above, China’s diamond tool products have achieved rapid development, with over a thousand diamond tool manufacturers and the formation of distinctive diamond tool industry belts to meet the needs of domestic and foreign markets.

- The diamond tool industry belt in the Yangtze River Delta is mainly distributed in Danyang, Suzhou, Wuxi, and Shanghai, and is mainly a private enterprise. The diamond tool factories here mainly engage in export business.

- The Pearl River Delta diamond tool industry belt is distributed in Nanhai, Foshan, Guangzhou, Dongguan and Yunfu, and is dominated by ceramic processing tools.

- The diamond tool industry belt in the Shijiazhuang area is mainly composed of private joint-stock enterprises, targeting domestic and international markets.

- The diamond tool industry belt in Beijing is mainly composed of state-owned joint-stock enterprises, mainly engaged in the export market.

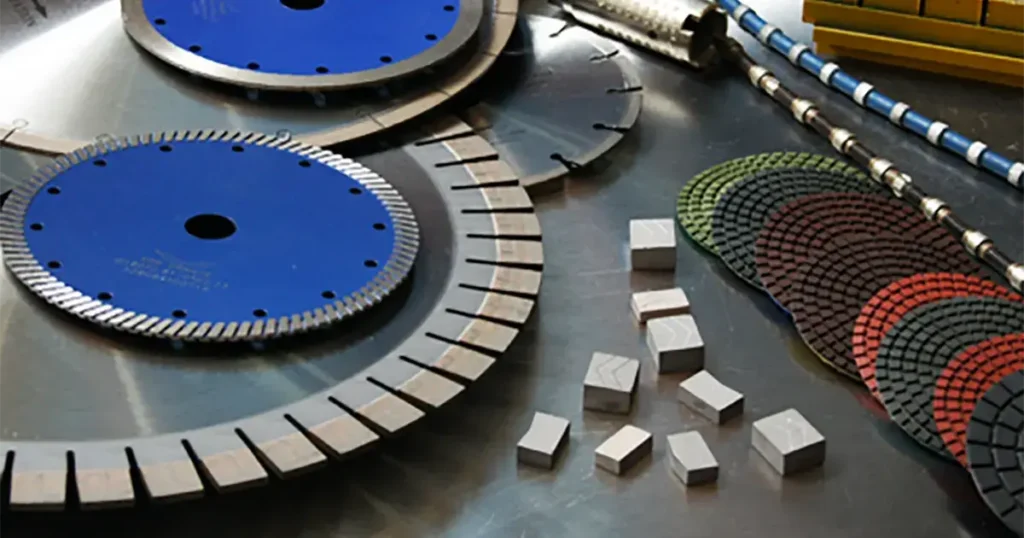

- The stone diamond tool industry belt is mainly distributed in Xiamen, Quanzhou, Nan’an Shuitou, Fuyun in Guangdong, and Laizhou in Shandong. It mainly produces diamond saw blades, diamond segments, polishing pads, wire saws, drill bits, etc. for processing stone, with a wide variety of categories. Diawe Tools is located in Quanzhou City.

- Originating from the Institute of Science and Technology, it has developed into a diamond tool research and production base with strong technical strength, always leading the new trend and forefront of diamond tools.